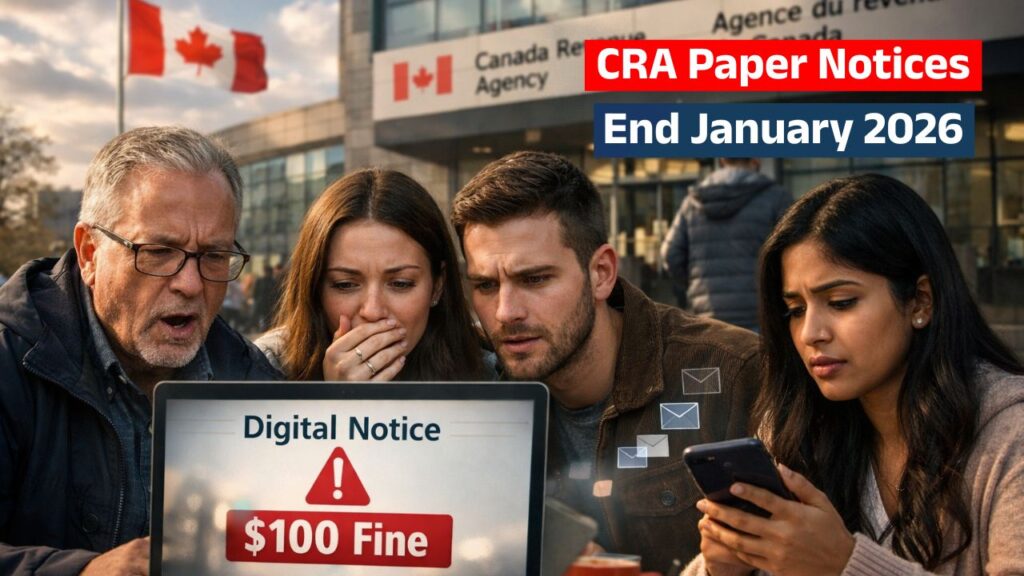

Goodbye to Paper CRA Notices – From 10 January 2026, Canada is taking a major step toward fully digital tax administration with the introduction of a new CRA digital notice rule. Under this change, most official Canada Revenue Agency communications will be delivered electronically instead of by paper mail. The move is designed to reduce delays, improve security, and cut administrative costs. However, taxpayers who fail to register for or regularly check their digital CRA account could face a $100 fine. This update affects millions of Canadians and marks a clear shift away from traditional paper notices.

CRA Digital Notices Rule for Canadian Taxpayers

The CRA digital notices rule means that official tax correspondence, including assessments, benefit updates, and compliance warnings, will now be issued primarily through the CRA’s online portals. For Canadian taxpayers, this change places greater responsibility on individuals to maintain active access to their CRA My Account or related digital services. The government has stated that digital notices are considered legally delivered once posted online, even if the taxpayer does not log in immediately. This makes regular account monitoring essential. The $100 fine applies when individuals ignore mandatory digital delivery requirements or fail to update contact preferences as required by the CRA.

Canada Revenue Agency Ends Most Paper Tax Notices

By ending most paper tax notices, the Canada Revenue Agency aims to modernize how it communicates with residents and businesses. Printed letters have long caused delays, especially during peak tax seasons or postal disruptions. With digital delivery, notices arrive instantly and are stored securely for future reference. Canadian residents who still prefer paper mail may find fewer opt-out options available after January 2026. Seniors, benefit recipients, and self-employed individuals are encouraged to seek assistance early if they are unfamiliar with online systems, as penalties can still apply regardless of digital literacy.

| Item | Details |

|---|---|

| Rule Start Date | 10 January 2026 |

| Notice Type | CRA digital notices only |

| Who Is Affected | Most Canadian taxpayers |

| Penalty Amount | $100 fine for non-compliance |

| Delivery Method | CRA My Account and portals |

$100 Fine Policy for Tax Notices Across Canada

The $100 fine policy is intended to encourage compliance rather than generate revenue. Across Canada, the government has emphasized that digital communication improves accuracy and reduces fraud risks linked to lost or stolen mail. The fine may apply if taxpayers ignore instructions to switch to digital notices or repeatedly fail to access required electronic communications. While the penalty is relatively modest, it can add up when combined with missed deadlines, interest, or other administrative charges. Staying digitally connected is now part of responsible tax management for individuals and businesses alike.

Digital Tax Communication Changes for Canadians

These digital tax communication changes reflect a broader shift in how public services operate in Canada. From benefit programs to immigration updates, online delivery is becoming the default. For Canadians, the CRA’s move signals that paper-based systems are no longer considered reliable enough for critical information. Taxpayers are advised to enable email alerts, keep login details secure, and update personal information regularly. Doing so not only avoids fines but also ensures timely awareness of refunds, audits, or benefit adjustments that could significantly affect household finances.

Frequently Asked Questions (FAQs)

1. When does the CRA digital notice rule start?

The rule officially takes effect on 10 January 2026.

2. Who can be fined $100 under this rule?

Most Canadian taxpayers who fail to comply with mandatory digital notice requirements may be fined.

3. Can I still receive paper notices from the CRA?

In most cases, paper notices will be limited, with digital delivery becoming the default option.

4. How do I avoid the CRA digital notice fine?

Register for CRA online services and check your account regularly for new notices.